Over the last two decades, the sad truth is that management has failed to advance as a discipline. Earlier articles in this series, here and here, showed how well-intended efforts to reform individual components of the management repertoire - leadership, strategy, entrepreneurship, innovation, HR, budgeting, and Agile management - mostly failed to spread across the firm in a sustained way.

Why? The main reason begins with the goal of the firm. Over the last half century, the goal of making money for shareholders went from being one aspect of capitalism to being the only thing that mattered. The fictional character, Gordon Gekko, in the 1987 movie, Wall Street, spoke for many real businessmen when he said: "Greed, for lack of a better word, is good." In 1997, the Business Roundtable (BRT) gave its stamp of approval and maximizing short-term shareholder value (MSV) became the official gospel of American business. Even though the BRT recognized its error in August 2019 and ostensibly withdrew its support, the practice of MSV remains as prevalent as before. MSV is also driven by grotesque increases in CEO compensation, which grew 940% between 1978 to 2019, while typical worker compensation rose only 12% during that time.

So long as the uninspiring goal of MSV remained the goal of the firm, bureaucracy and tight control were essential to ensure compliance. Moreover, all the other components of management - strategy, entrepreneurship, innovation, HR, and budgeting - had to be aligned to support the goal. As a result, efforts to change individual components of management encountered something like the response of an autoimmune system that combines to fight and prevent change.

The Re-Imagination of Management Itself

It is time to accept that sustained change in the firm as a whole will not be accomplished by efforts to fix individual components of industrial-era management, no matter how well conceived. What is needed is to re-imagine the very concept of management itself.

It begins by taking to heart Peter Drucker’s 1954 insight, “There is only one valid purpose of a firm - to create customers.” It means re-conceiving management comprehensively in a way that liberates the entrepreneurial spirit, and thereby generating innovation, engagement, and improved productivity. Happily, this fundamentally different way of running a company - let’s call it customer capitalism - is already well under way in the most financially successful firms.

These firms have embraced a radically different set of principles:

- The goal of the firm is to create value for customers, along with a business model that generates profits as a result.

- The firm mostly deploys team-based arrangements

- Instead of starting from what the firm can produce that might be sold to customers, firms work backwards from what customers need and then figure out how that might be delivered in a sustainable way.

- Instead of limiting themselves to what the firm itself can provide, the firm often mobilizes other firms to help meet user needs.

- Instead of the steep hierarchies of authority of industrial era-firms, digital firms tend to be organized in horizontal networks of competence.

Once these principles are in place, the firm can embrace processes that are also the opposite of industrial-era management.

- Leadership now occurs at every level, not just the top;

- Strategy is dynamic, interactive, and value-creating;

- Innovation enhances existing businesses and creates new businesses;

- Sales and marketing are now about making a difference for customers and users;

- HR is about attracting and enabling talent;

- Operations is about exceeding expected outcomes at lower cost, not just outputs:

- Budgeting is driven by strategy.

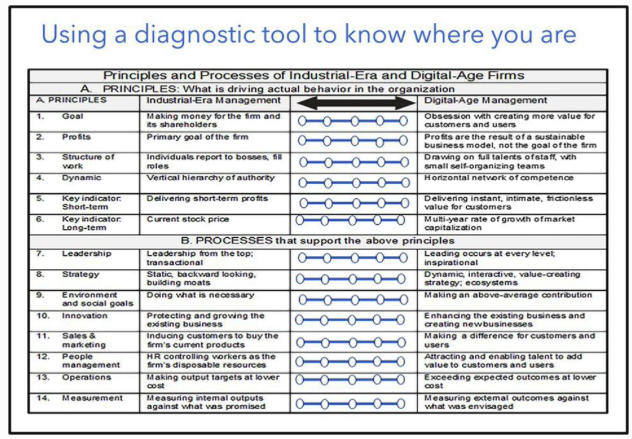

The convergence among the most financially successful firms towards this pattern of principles and processes is striking. And note that these principles and processes are the opposite of the industrial-era firm, as shown in the diagnostic tool in Figure 2 below.

Find more insights about this theme in Steve Denning's new book: Reinventing Capitalism in the Digital Age

Buy Here

The Consequences of Operating This Way

The consequences for customers of operating this way have been remarkable. Firms operating this way have been transforming everything society does—how we work, play, shop, access knowledge, learn, entertain ourselves, communicate, move about, stay healthy and even how we worship. For better or worse, our lives are becoming as different from those of the industrial era as those of the industrial era were different from the agricultural age.

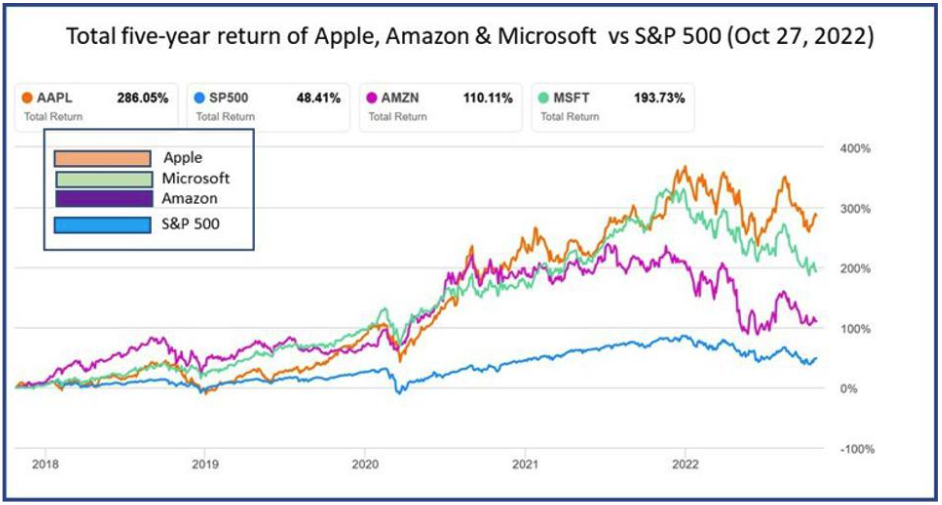

The financial consequences for firms themselves are equally extraordinary. When firms are run consistently like this over a period of years, as at Apple, Amazon and Microsoft, the long-term growth of market capitalization is well above the S&P 500 average, even in the current downturn, as shown in Figure 1.

Figure 1: Total 5-year return of Apple, Amazon and Microsoft vs S&P 500 (Oct 27, 2022) STEVE DENNING; SEEKING ALPHA

Why Most Attempts At Digital-Age Management Fail

Most large industrial-era firms see that their current way of operating cannot compete with these gains. Most are attempting digital transformations at various speeds and intensities.

Yet many of these efforts are based on the misperception that the gains of big tech firms are due to the adoption of digital technology, and fail to recognize that succeeding with digital technology requires fundamentally different management. The result is generally a mishmash of industrial-era and digital-age principles and processes that are no more effective than trying to run from a tsunami crashing onshore.

Digital-age Management is the Opposite of Industrial-Era Management

The principles and processes of the two modes of management are not merely different. In most cases they are the opposite of each other. They require a change of mindset and a change of heart. Firms have to think and feel differently.

To begin to make the transition to digital-age management, firms need to understand and concept of digital-age management and then diagnose the current state of their firm, with a simple diagnostic tool, shown in Figure 2.

Figure 2: Diagnostic tool for industrial-ear and digital-age managemet, by STEVE DENNING

Without such a diagnostic tool, managers and consultants, risk making the effects of market disruption worse, with actions such as CEO firings, downsizings, delayerings, reorganizations, and efficiency drives. Such managers and consultants don’t intend harm: they take those steps because they have no way of making an objective assessment of the state of the firm or the organizational dysfunctions that need treating.

Using of the Diagnostic Tool can be Brutal

It is important to use the tool to get perceptions at different levels of the firm. Given the tendency for the level of self-delusion to increase with organizational level, it is not unusual to find starkly different perceptions at the top as compared to lower down.

One risk of the using diagnostic tool honestly can be shock at the scale of the implied change, when executives start to see how far they have to go to become a strongly performing digital-age firm, and how long it will take. That however is the reality.

Grasping that reality is the point of a diagnostic tool. It is not pleasant to discover that one has a serious disease, but that discovery can enable doing something about it. The disease of industrial-era management is not necessarily lethal. Apple, Amazon, and Microsoft recovered from it. Other CEOs like Bill Anderson at Roche Pharmaceuticals and Kevin Nolan at GEA are on the same track.

The transition to digital-age management is not easy but anecdotal evidence suggests that it is not necessarily painful. It can be liberating. Command-and-control executives are often not happy people. And we know from world-wide data from Gallup that most of the staff are not fully engaged in industrial-era firms. When firms make the transition to this new way of operating, people can be honest with each other for perhaps the first time.

This article was written by Steve Denning to Forbes, on October 28th of 2022. You can find the original article here.